The Department of Small Business Development may have to cut some of its planned projects to support small businesses after the National Treasury last month effectively slashed a third of its requested allocation from the fiscus.

Finance Minister Nhlanhla Nene revealed during his 2015 Budget Speech last month that the department would be allocated R3.5 billion between 2015/16 and 2017/18.

The department had wanted more. It asked for an allocation of R5.2 billion when it presented its 2014-2019 strategic plan to Parliament’s small business development portfolio committee in October last year.

While R662 million of the slashed amount was to go to the Incubator Support Programme (ISP), which has been retained by the Department of Trade and Industry, the National Treasury didn’t approve a further R1 billion that the department wanted.

Lindiwe Zulu and her department have had to scale back some of the plans outlined in its 2014-2019 strategic plan, which sets out its program proposals to be funded between 2015/16 and 2017/18.

For example, in its 2014-2019 strategic plan, it has aimed to support 6,400 small businesses with export readiness training, but the National Treasury’s Estimates of National Expenditure for the department for 2015 puts this as 3,700 small businesses that will be helped to get export ready.

The department wants to launch several new programs over the coming three years. These include a new enterprise cadet scheme, a mass youth enterprise creation program, a new export village program, and a new micro-franchising incentive. It’s unclear whether these will go ahead with the reduced budget now.

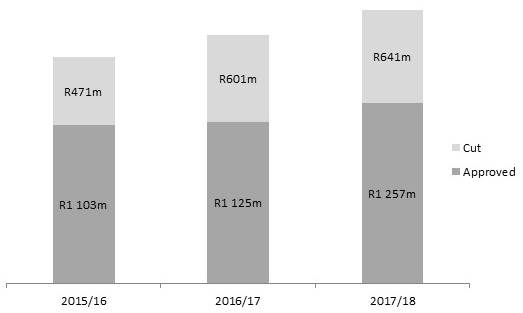

Amount in millions or rands approved by the fiscus for allocation (darker shade) to the Department of Small Business Development and the amount (lighter shade) not approved. Sources: Department’s 2014-2019 strategic plan and National Treasury’s 2015 Estimates of National Expenditure for the department.

Department’s plans

The department would oversee all those support programs for small businesses that previously fell under the departments of trade and industry and Economic Development.

These include the Small Enterprise Development Agency (Seda) and the Small Enterprise Finance Agency (Sefa), as well as those incentive grants from the Department of Trade and Industry that are aimed at small businesses.

Seda, which assists business owners with training and mentoring, has been given a budget of R653 million for 2015/16 (including R132 million to be spent on incubation). This climbs to R746 million by 2017/18, less than the R805 million the department had requested be allotted to the agency for that financial year.

In 2015/16 the agency expects to work with 11,400 new and existing small businesses and support 51 incubators (up from the current 48) which will in turn help incubate 1,795 entrepreneurs.

The department would complement this by setting up 20 centers of entrepreneurship to offer sector-specific training, at FET colleges across the country. So far four have been launched since last year.

Sefa received an initial three-year allocation of R1.4 billion from the IDC and the government when it was set up in 2012 and as such hasn’t been allocated amounts from the fiscus. The agency aims to disburse R816 million in 2015/16 to over 31,000 beneficiaries, up from R640 million to over 37,000 in 2014/15.

The department will also aim to disburse R686 million in cost-sharing incentives through the Black Business Supplier Development program to offer marketing and business support to black firms and a further R229 million to co-operatives through the Co-operative Incentive Scheme to help them acquire machinery. Both schemes were previously under the Department of Trade and Industry.

Over 2,400 small businesses and over 900 cooperatives are expected to be supported over the next three years by these incentives, the National Treasury says in the Estimates of National Expenditure for the department for 2015.

The National Treasury also notes that the department will facilitate the implementation of the Youth Black Business Supplier Development Programme which is intended to benefit 1,100 youth enterprises by 2017/18 and contribute to women’s development by providing training to 1,500 women entrepreneurs through the Bavumile skills development program, by 2017/18.

Township focus

The department also plans include help the 3,300 informal sector through its Informal Traders Upliftment Project and get municipalities to partner through the development of infrastructure for informal traders in townships and rural areas.

In addition, the department also wants to finalize a micro franchising incentive, in which it aims to get 110 small enterprises and co-operatives transformed into micro franchisors

Other plans

The department also wants to set up the Co-operatives Development Agency this financial year and amend the National Small Business Act (to include a new definition for small business among other things).

Among its long-term priorities, the department wants to set up a national survey where periodic and reliable statistics on the small business sector can be made available.

The graphic shows relative budget allocations to small business departments or secretariats and (on the x access) their percent increase or decrease in budgetary allocations over the previous year (South Africa’s illustrates the difference in requested and allocated funds for 2015. Sources: Finance ministries of South Africa, Chile, and India and Planning ministry and Sebrae for Brazil.

How SA compares

A comparison by Small Business Insight with four other emerging economies, reveals that Brazil’s budget to support small businesses is about 17 times that of South Africa’s. This is despite its economy being only six times the latter.

Brazil’s secretariat for small business will get 78.7 million reals in 2015. In addition, the 2015 budget for its SME agency Sebrae is some 5 billion reals ($1.5 billion), moving from 4.1 billion reals in 2014 (Read more about Sebrae in this post).

While allocations to India’s Ministry of Micro, Small and Medium Enterprises fell 19% – from 37 billion rupees last year to 30 billion rupees or $480 million (proportionately about the same size as South Africa’s small business budget for this year) for 2015/16, according to the demand for grants from India’s finance ministry, spending on small businesses in Chile is to increase by 37.5% over 2014.

Chile’s Ministry of Finance has allocated 199.3 billion pesos or $311 million (proportionately about three times bigger than South Africa’s) to the sub-directorate for small businesses in the Ministry of Economy. The amount includes subsidies to the small business agency Corfo.

A better way to fund support?

The cuts by the fiscus perhaps show just how tight funding for small businesses will be. Nonetheless, Chile and Brazil have been able to find more money.

Chile’s Corfo is funded via a mining royalty, while about two-thirds of the available spending for Sebrae’s this year comes from a special tax on the payrolls of business. The economy may be in the doldrums in Brazil, but about a quarter of Sebrae’s current funds are unused allocations from previous years. Perhaps for some countries, a better way to fund small business support needs to be considered.

In the years following the readjustments to the finances, the Department of Small Business Development has been working in a tight environment with less cash.

And even though such sources are restricting, the branch is devising ways and manners in which to preserve proffering the assistance, guidance, and assistance it normally gives small corporations—similar offerings, even up to their utility control, like knowing and controlling their mepco bill.

The focus now could be on getting maximum bang for every rand outlay. The department has therefore sought to streamline operations and awareness programs on the ones that can grow and be maximum sustained in the sort of sector. One is digitalization, similarly more suitable with the best focus on e-commerce in view that virtual models of commercial enterprise have exploded all around the globe.

The approach could be designed to empower those small companies with the needed resources and expertise that might permit them to compete inside a digital marketplace—one that is ever-stretching in addition at the same time as controlling the operative overhead prices, especially those referring to utilities.

The branch has in addition better partnerships with corporate companies using the usage of those collaborations to benefit introduced investment and further resources so one can be employed in assisting small businesses.

There are more fees that such frequently bring on; aside from delivered costs as help from the entrepreneur through the application payments, they could assist in cutting charges by optimizing the usage of electricity.

Hi, I’m Sophie. As a digital creator and avid enthusiast in Business, Marketing, Finance, Tech, and News, I’m dedicated to delivering rich and engaging insights.

If you’re curious or have thoughts to share, let’s connect!

Contact: sophiekotecki@gmail.com